insurance

Good News for ‘Typical’ Home Buyers

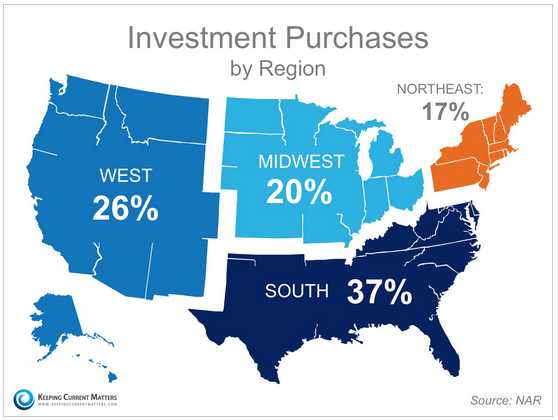

(Above is a map detailing the investment purchases in 2014 by region.)

In a speech delivered earlier this year, Secretary for HUD Julián Castro, called 2015 “A Year of Housing Opportunity”. A recent report by The National Association of Realtors (NAR) revealed that investment home sales decreased 7.4% in 2014 to an estimated 1.02 million.

What does this mean for the ‘typical’ homebuyer?

Lawrence Yun, NAR’s Chief Economist gave some insight:

“Despite strong rental demand in many markets, investment property sales have declined four consecutive years to their lowest share since 2010 as rising home prices and fewer distressed properties coming onto the market have further reduced the number of bargains available to turn into profitable rentals.”

This is great news for the housing market. If fewer properties are being sold to investors, they are instead being sold to American families who are entering the housing market in droves.

Details…

View original post 265 more words

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture and tagged agent, algonquin, broker, buying home, community, communityrealestate360, condominiums, Condos, cook, crystal lake, dupage, economy, first time home buying, flipping, foreclosures, future, home insepection, home insurance, home value, huntley, insurance, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, mortgage, mortgage insurance, northern illinois, property, property for sale, real estate.

FOMC Meeting Forecast – The FED

FEDS LOOKING AT RATE HIKES, BUT NOT UNTIL MAYBE JUNE AT THE EARLIEST OR MORE PROABABLY SEPTEMBER. @realtorcouture

Who can forget the last 2014 FED´s meeting, when Janet Yellen talked for the first time of a possible date for rate hike, and talked about the probability of a couple of months, and not before April? During the December meeting, the FED said that it would be “patient” on rates, and said it was unlikely they will change the economic policy at least for a “couple of meetings”, with Chair Janet Yellen clarifying then that a couple of meetings meant not before April. At the time, the Central Bank was confident on the economic outlook, saying that that the “economic activity has been expanding at a solid pace” and market run to price in a rate hike for June.

But as the months went by, persistent softness in the economy, with macroeconomic data printing some horrid numbers, has diminished hopes the Central Bank will act that soon.

On…

View original post 441 more words

This entry was posted in Uncategorized and tagged agent, algonquin, broker, buying home, community, communityrealestate360, condominiums, Condos, cook, crystal lake, dupage, economy, first time home buying, flipping, foreclosures, future, home insepection, home insurance, home value, huntley, insurance, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, mortgage, mortgage insurance, northern illinois, property, property for sale, real estate, realestate.com, Realtor, realtor.com, realty, realty executives, selling, selling home, short sales, spring home sales, todd couture, trulia, want to sell my home, whats my home worth, woodstock, zillow.

Condominium Insurance 101

Tori Denton, PSA, Realtor Licensed MA & CT

Condominium Insurance

Condominium Insurance

One of the benefits of condominium living is that you can enjoy the financial benefits of owning your own home without the time or expense of home maintenance. However, the benefits of belonging to a condo association don’t take away all responsibility if disaster strikes. Although your condo may be covered by master insurance, you should strongly consider purchasing your own condo insurance policy to make sure you are covered in all situations.

Facts

Part of your homeowner’s association dues goes to pay for insurance on your condo complex. If the building burns down, or the roof blows away in a hurricane, you should be covered by your condo’s master insurance policy. Additionally, the master insurance policy will usually carry specialized insurance, such as flood or earthquake insurance. However, this policy won’t cover anything inside your individual unit, so you should consider separate condo insurance to insure your…

View original post 343 more words

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture, Uncategorized and tagged buying home, communityrealestate360, condominiums, Condos, home insurance, huntley, insurance, mchenry county, mortgage insurance, real estate, realty, selling home, todd couture.