buying home

Is Fall The Best Time To Buy A House?

If you’re serious about buying a home, fall might be the perfect time of year to make it happen. But it has a particular set of challenges too. READ MORE

Ready to Sell Your Home? Ready to Buy? Search for Homes for sale in Columbia, South Carolina & Search for Homes for sale in Lexington and Lake Murray, South Carolina

This entry was posted in @huntley360, @realtorcouture, local news, todd couture real estate agent and tagged @huntley360, @realtorcouture, buying home, real estate, selling a home, todd couture huntley real estate agent.

This entry was posted in buying a home, homes for sale, real estate agent huntley illinois, realty executives, todd couture and tagged buying home, huntley illinois, looking for a new home, real estate agent in mchenry county, todd couture.

5 Things You Absolutely Must Do Before Buying a Home

5 Things You Absolutely Must Do Before Buying a Home

Purchasing real estate can be a complex process, and it’s essential for people who want to make a smart wealth-building decision to buy the right property that suits their long-term needs. To prepare yourself for this life-changing event, be sure you take the following steps before starting the process. READ MORE

Ready to Sell Your Home? Ready to Buy? Search for Homes for sale in Columbia, South Carolina & Search for Homes for sale in Lexington and Lake Murray, South Carolina

This entry was posted in buying home, real estate, real estate agent huntley illinois, todd couture and tagged @realtorcouture, algonquin, buying home, huntley, huntley illinois, real estate, realty executives cornerstone, todd couture.

Does Buying Beat Renting?

Call Todd Couture if your interested in listing your home, buying a home, renting, OR IF YOU KNOW SOMEONE who might me – I would look forward to the opportunity

This entry was posted in broker, buying home, for rent, for sale, mchenry county, selling home, todd couture and tagged agent, buying a home, buying home, communityrealestate360, first time home buying.

Step-by-Step Guide to Home Buying

| HARLOW REALTORS | mid-city speacialist |

- Read, research and decide. Do the math and make sure that this decision benefits you. 10 Signs you’re ready to buy a home!

- Find a local REALTOR that specializes in what you looking to do.

- The REALTOR® can point you in the direction to a lender that would best suite your needs.

- If you’re not equipped to buy, don’t fret! The lender and agent will help you take the steps needed, and give you TIPS to get you where you need to be.

- Every market is different, and every seller has different requirements. Your agent can help prepare you for any upfront costs associated with buying your home.

- Look, play around in the MLS, drive by areas! How do I choose the right neighborhood?

- Once you find a home, in an area and at a price point that works for you, you will write an offer.

- Every market is different. In…

View original post 204 more words

This entry was posted in agent, broker, buying home, for sale, mchenry county, real estate and tagged algonquin, buying a home, buying home, communityrealestate360, crystal lake, first time home buying, home buying.

Why Every Buyer Needs Their Own Realtor

When we went home shopping we were told by our friend that we should look into getting our own Realtor. Our friend suggested himself, obviously. I am so glad we listened to Ryan’s advice.

Ryan took the time to get to know what we wanted in a home. He steered us in the right direction both price and concept wise. He allowed us to stay focused and helped us find our home.

When we found the right home, he went to work. He sat us down and explained how putting an offer on a house worked. He told us realistically what the house was estimated to be worth and helped us come up with a “just right offer.” When the seller counter-offered he explained why and guided us in the right direction. Thanks to him we got a great deal on a house we absolutely love.

Then came the complicated…

View original post 219 more words

This entry was posted in agent, broker, buying home, for sale, mchenry county, real estate, realty executives, todd couture and tagged 847-471-1434, agent, broker, buying home, communityrealestate360, crystal lake, first time home buying, home market, lakeinthehills, Realtor, spring home sales, spring market, todd couture.

Good News for ‘Typical’ Home Buyers

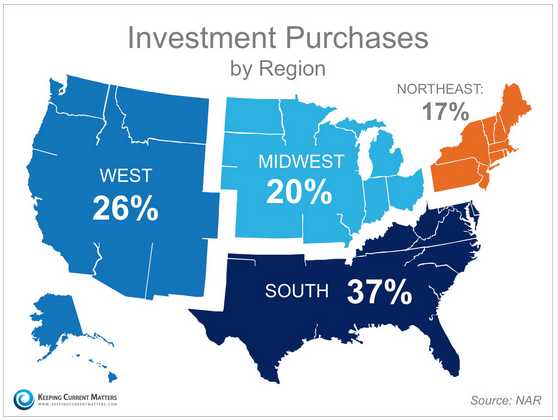

(Above is a map detailing the investment purchases in 2014 by region.)

In a speech delivered earlier this year, Secretary for HUD Julián Castro, called 2015 “A Year of Housing Opportunity”. A recent report by The National Association of Realtors (NAR) revealed that investment home sales decreased 7.4% in 2014 to an estimated 1.02 million.

What does this mean for the ‘typical’ homebuyer?

Lawrence Yun, NAR’s Chief Economist gave some insight:

“Despite strong rental demand in many markets, investment property sales have declined four consecutive years to their lowest share since 2010 as rising home prices and fewer distressed properties coming onto the market have further reduced the number of bargains available to turn into profitable rentals.”

This is great news for the housing market. If fewer properties are being sold to investors, they are instead being sold to American families who are entering the housing market in droves.

Details…

View original post 265 more words

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture and tagged agent, algonquin, broker, buying home, community, communityrealestate360, condominiums, Condos, cook, crystal lake, dupage, economy, first time home buying, flipping, foreclosures, future, home insepection, home insurance, home value, huntley, insurance, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, mortgage, mortgage insurance, northern illinois, property, property for sale, real estate.

FOMC Meeting Forecast – The FED

FEDS LOOKING AT RATE HIKES, BUT NOT UNTIL MAYBE JUNE AT THE EARLIEST OR MORE PROABABLY SEPTEMBER. @realtorcouture

Who can forget the last 2014 FED´s meeting, when Janet Yellen talked for the first time of a possible date for rate hike, and talked about the probability of a couple of months, and not before April? During the December meeting, the FED said that it would be “patient” on rates, and said it was unlikely they will change the economic policy at least for a “couple of meetings”, with Chair Janet Yellen clarifying then that a couple of meetings meant not before April. At the time, the Central Bank was confident on the economic outlook, saying that that the “economic activity has been expanding at a solid pace” and market run to price in a rate hike for June.

But as the months went by, persistent softness in the economy, with macroeconomic data printing some horrid numbers, has diminished hopes the Central Bank will act that soon.

On…

View original post 441 more words

This entry was posted in Uncategorized and tagged agent, algonquin, broker, buying home, community, communityrealestate360, condominiums, Condos, cook, crystal lake, dupage, economy, first time home buying, flipping, foreclosures, future, home insepection, home insurance, home value, huntley, insurance, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, mortgage, mortgage insurance, northern illinois, property, property for sale, real estate, realestate.com, Realtor, realtor.com, realty, realty executives, selling, selling home, short sales, spring home sales, todd couture, trulia, want to sell my home, whats my home worth, woodstock, zillow.

Condominium Insurance 101

Tori Denton, PSA, Realtor Licensed MA & CT

Condominium Insurance

Condominium Insurance

One of the benefits of condominium living is that you can enjoy the financial benefits of owning your own home without the time or expense of home maintenance. However, the benefits of belonging to a condo association don’t take away all responsibility if disaster strikes. Although your condo may be covered by master insurance, you should strongly consider purchasing your own condo insurance policy to make sure you are covered in all situations.

Facts

Part of your homeowner’s association dues goes to pay for insurance on your condo complex. If the building burns down, or the roof blows away in a hurricane, you should be covered by your condo’s master insurance policy. Additionally, the master insurance policy will usually carry specialized insurance, such as flood or earthquake insurance. However, this policy won’t cover anything inside your individual unit, so you should consider separate condo insurance to insure your…

View original post 343 more words

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture, Uncategorized and tagged buying home, communityrealestate360, condominiums, Condos, home insurance, huntley, insurance, mchenry county, mortgage insurance, real estate, realty, selling home, todd couture.

Former distressed homeowners with restored credit are re-entering the housing market

Nearly a decade since the start of the foreclosure crisis, formerly distressed homeowners with restored credit are re-entering the housing market, but damaged credit profiles and lender overlays will greatly restrict the overall share of those eligible to buy, according to new research from the National Association of Realtors®.

NAR analyzed the nearly 9.3 million homeowners that underwent a foreclosure, received a deed-in-lieu of foreclosure, or short sold between 2006 and 2014 to estimate the amount of creditworthy borrowers expected to re-enter the housing market as a return buyer in upcoming years.

The findings reveal nearly a million of these former owners have likely already purchased a home again, and an additional 1.5 million are likely to become eligible and purchase over the next five years, representing an additional source of buyer demand for the housing market. However, because of low credit quality, millions more will not be able to re-enter in the coming decade.

Lawrence Yun, NAR chief economist, says there were two waves of defaults during the housing crisis: from subprime and then prime borrowers. “While loose lending standards in the mid-2000’s led to the rise in subprime buyers who ultimately became distressed owners, falling home prices and rising unemployment resulted in a large share of prime borrowers also defaulting or going through a short sale,” he said. “Now fueled by a gradually improving economy and the strong rebound in home prices, some of these former distressed owners have returned to the market, and more will likely become eligible in coming years.”

Several important factors were taken into account in NAR’s study, including the time necessary to repair a distressed seller’s credit, whether the distressed seller’s credit profile (at the time of purchase) fell below historic standards, if it met sound underwriting standards and whether they would meet credit overlays in the current stringent environment.

The findings show that roughly 950,000 former distressed owners of prime quality have become re-eligible for Federal Housing Administration or similar financing programs and have likely purchased again by restoring their credit to pre distress levels. Furthermore, 1.5 million formerly distressed owners will likely buy again over the next five years as they become eligible, with California, Florida and Arizona seeing the largest share of return buyers.

Despite the new source of housing demand from these return buyers, Yun says the considerable impact a distressed sale has on a borrower’s credit score will severely limit the overall number of those returning. “The extended time needed to repair credit scores or save for a downpayment, combined with other overlapping post-distress factors on credit quality such as missed auto loan or credit card payments, will limit the ability for many to buy in the current credit environment,” he said.

Looking ahead, because of the time that has elapsed and the fact that many distressed owners likely rented and paid utility bills in recent years, Yun says the use of new credit scoring models such as Vantage Score 3.0 and FICO 9 can help improve the ability of these buyers to become homeowners again while helping lenders further examine their credit risk to ensure safety and soundness in the market.

“The deep wounds inflicted on the housing market during the downturn are finally beginning to heal as distressed sales continue to decline and home prices in some parts of the country have bounced back to their near-peak levels,” adds Yun. “Borrowers with restored credit will likely have the ability and desire to own again, encouraged by the long-term benefits homeownership provides in a stronger economy and more stable job market.”

The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1 million members involved in all aspects of the residential and commercial real estate industries.

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture and tagged agent, algonquin, broker, buying home, community, cook, crystal lake, dupage, economy, first time home buying, flipping, foreclosures, future, home insepection, home value, huntley, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, mortgage, northern illinois, property, property for sale, real estate, realty, realty executives, selling, selling home, short sales, spring home sales, todd couture, want to sell my home, whats my home worth, woodstock.