@huntley360

What Do You Really Need to Qualify for a Mortgage?

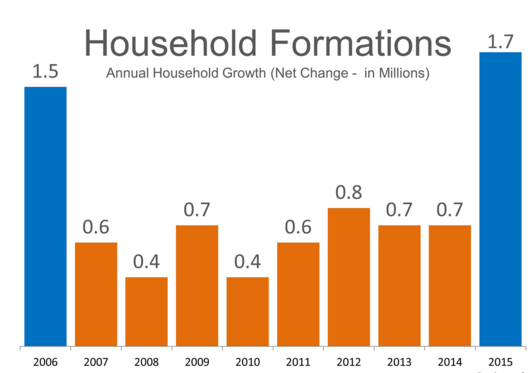

It appears that Millennials are finally beginning to enter the housing market. In a recent report, CoreLogic looked at the annual net change in household formations over the last decade (see graph below):

It appears this is the year that Millennials are finally moving out of their parents’ basements and finding a place of their own. And they are not all renting

According to the National Association of Realtors’ latest Existing Home Sales Report, the percentage of first–time buyers rebounded to 32 percent in August, up from 28 percent in July and matching the highest share of the year set in May.

What has kept the others from buying a home?

Recent surveys have revealed that there are major misunderstandings as to what is required to get a mortgage in today’s lending environment. Many Americans believe you need at least a 780 FICO score and a 20% down…

View original post 172 more words

THE FED HOLDS, STOCKS FOLD! SINGLE FAMILY BUILDING PERMITS HIGHEST SINCE 2008.

INFO THAT HITS US WHERE WE LIVE… Some people felt there was really nothing to say after Housing Starts dropped 3.0% in August, to a 1.126 million annual rate. But, as usual, a deeper dive into the data gives us plenty to talk about. While it’s obvious that home building took a summer break in August, it’s been pretty active the last 12 months, with starts in that period up 14.9% for single-family units and up 16.6% overall. Some see that trend continuing at least through the end of 2016. They say that with population growth and tear downs, housing starts need to get to about 1.5 million units annually, so there’s lots of recovery still to come.

We could get there sooner than some think, since new building permits went up 3.5% in August, climbing to a 1.170 million yearly rate. In fact, single-family permits are now at their highest level since January 2008. No wonder the National Association of Home Builders confidence index reached its best reading since October 2005. Before the Fed left rates unchanged on Thursday, Freddie Mac’s chief economist said, “Even if the Fed decides to raise short-term interest rates, we don’t expect a significant impact on the housing market.” A good thought to remember whenever the Fed finally hikes rates. He added: “We’re still on track for the best year of home sales since 2007.”

THE FED HOLDS, STOCKS FOLD… Regular Inside Lending readers weren’t surprised by the Fed’s decision last week to hold rates down. Our prior edition pegged the probability of a rate hike at just 23%. The mass media felt otherwise, hinting rates would likely go up at Thursday’s meeting. This was strange, as the probabilities we report come from public sources respected by many economists. After the Fed’s rate hold, stocks folded, as the Dow fell 290 points Friday, leaving it and the S&P 500 down for the week and the Nasdaq barely ahead. This was blamed on the Fed’s doubts about U.S. and global economic strength, but Friday was also a volatile quarterly “quadruple witching” day.

Some analysts see the current stock downturn as purely a technical correction, driven by investors taking profits after a long bull market run. These folks point out that although the economy is far from booming, it is making progress, if ever so slowly. One aspect of that progress was the 0.2% gain for Retail Sales in August. Unfortunately, the manufacturing sector didn’t fare as well, with Industrial Production, Capacity Utilization, the New York Empire and Philadelphia Fed Indexes all posting declines. On the other hand, Initial Unemployment Claims dipped to their lowest level in two months, while Continuing Unemployment Claims fell to 2.237 million.

The week ended with the Dow down 0.3%, to 16385; the S&P 500 down 0.2%, to 1958; and the Nasdaq UP 0.1%, to 4827.

Bonds did well, strongly rallying as global stock markets and oil prices suffered steep declines. The 30YR FNMA 4.0% bond we watch finished the week UP .12, to $106.20. Freddie Mac’s Primary Mortgage Market Survey for the week ending September 17 showed national average fixed mortgage rates largely unchanged. Remember, mortgage rates can be extremely volatile, so check with your mortgage professional for up to the minute information.

DID YOU KNOW?…”Quadruple witching” day is when stock index futures, stock index options, stock options, and single stock futures all expire. Since investors must close out of their positions, there’s usually high volatility and trading volumes. It’s the third Friday of the last month of each quarter.

This Week’s Forecast

HOME SALES UP AND DOWN, BUSINESS INVESTMENT OFF, ECONOMY GROWS… The typically mixed bag of economic data includes August Existing Home Sales, forecast a bit down, and New Home Sales, a bit up. Durable Goods Orders should show business investment slightly on the wane, yet the GDP – 3rd Estimate is expected to report economic growth holding at 3.7%.

>> The Week’s Economic Indicator Calendar

Weaker than expected economic data tends to send bond prices up and interest rates down, while positive data points to lower bond prices and rising loan rates.

Economic Calendar for the Week of Sep 21 – Sep 25

| Date | Time (ET) | Release | For | Consensus | Prior | Impact |

| M Sep 21 |

10:00 | Existing Home Sales | Aug | 5.50M | 5.59M | Moderate |

| W Sep 23 |

10:30 | Crude Inventories | 9/19 | NA | -2.104M | Moderate |

| Th Sep 24 |

08:30 | Initial Unemployment Claims | 9/19 | 271K | 264K | Moderate |

| Th Sep 24 |

08:30 | Continuing Unemployment Claims | 9/12 | 2.248M | 2.237M | Moderate |

| Th Sep 24 |

08:30 | Durable Goods Orders | Aug | -2.0% | 2.2% | Moderate |

| Th Sep 24 |

10:00 | New Home Sales | Aug | 515K | 507K | Moderate |

| F Sep 25 |

08:30 | GDP – 3rd Estimate | Q2 | 3.7% | 3.7% | Moderate |

| F Sep 25 |

08:30 | GDP Deflator – 3rd Est. | Q2 | 2.1% | 2.1% | Moderate |

| F Sep 25 |

10:00 | U. of Michigan Consumer Sentiment – Final | Sep | 87.0 | 85.7 | Moderate |

Federal Reserve Watch

Forecasting Federal Reserve policy changes in coming months…The Fed’s move last week to leave the Funds Rate unchanged has led most economists to think we won’t see a hike now til next year. Note: In the lower chart, an 11% probability of change is an 89% certainty the rate will stay the same.

Current Fed Funds Rate: 0%–0.25%

| After FOMC meeting on: | Consensus |

| Oct 28 | 0.00%-0.25% |

| Dec 16 | 0.00%-0.25% |

| Jan 27 | 0.00%-0.25% |

Probability of change from current policy:

| After FOMC meeting on: | Consensus |

| Oct 28 | 11% |

| Dec 16 | 39% |

| Jan 27 | 49% |

NEW LISTING!!! 409 CLEARVIEW AVE. WAUCONDA, IL 60084

409 CLEARVIEW, WAUCONDA, IL

$219,900 – 4 BEDROOM – 2 BATH – 1882 SQUARE FEET – BANGS LAKE

THIS CAPE COD HOME WILL GIVE YOU THE LIFESTYLE YOU’VE BEEN DESIRING. BRING YOUR TOYS! JUST 2 BLOCKS FROM #BANGSLAKE FOR BOATING, FISHING AND BEACH AND NEAR FOREST PRESERVE TO SNOWMOBILE OR HIKE ON THE TRAILS. ALL WITHIN A WALK. 1882 SQUARE FEET WITH 4 BEDROOMS,

THIS HOME HAS HAD TONS OF UPDATES WITHIN THE LAST 10 YEARS. 2-ZONE HEATING AND AIR, UPDATED COUNTERTOPS AND MAPLE CABINETS, 200 AMP SERVICE, GROHE AND MOEN FAUCETS THROUGHOUT. LARGE BACKYARD FEATURES A DOUBLE CEDAR GATE TO KEEP YOUR BOAT AND YOUR OTHER TOYS SAFE! THE YARD ALSO FEATURES A SHED AND THE OPPORTUNITY TO HAVE A NICE BACKYARD PARTY OR JUST RELAX ON THE PATIO.

MAIN FLOOR FEATURES A WOOD BURNING STOVE. NICE SIZED BEDROOMS. NEIGHBORHOOD IS APPEALING TO FAMILIES WITH CHILDREN TOO WITH PLENTY TO DO!! PART OF THE ROOF REPLACED JUST 3 YEARS AGO.