agent

Open House: Turnberry Golf Course Home, January 31st 12-3pm

7511 Fairview Drive, Crystal Lake IL 60014 $199,900

Jan. 31st 2016 – 12pm-3pm

This entry was posted in @huntley360, @realtorcouture, agent, buyer's market, buyers market, buying a home, buying home, fix up my home, flip homes, for sale, foreclosures, home buyers, home buying, home ownership, home value, homes for sale, invesment property, listing my home, mchenry county, mortgage rates, open house, owning a home vs renting, real estate, real estate agent todd couture, www.communityrealestate360 and tagged crystal lake illinois, foreclosures, local news, mchenry county, OPEN HOUSE, todd couture, turnberry country club.

This entry was posted in agent, broker, local news, real estate, realty executives, todd couture and tagged realty executives.

How Interest Rates Affect Your Purchase Price

Homeowners may want to worry more getting a good solid rate, and worry less about getting the cheapest deal possible. @realtorcouture

How Interest Rates Affect Your Purchase Price – When considering buying a home, it’s important that buyers understand how interest rates affect the purchase price. Interest rates play a large role in ultimately determining how much a buyer will pay for a home; it’s not just the sticker price. Read on for more information on how interest rates affect the price of a home from Realtor.com, Investopedia, and Home Guides.

How Interest Rates Affect Your Purchase Price – When considering buying a home, it’s important that buyers understand how interest rates affect the purchase price. Interest rates play a large role in ultimately determining how much a buyer will pay for a home; it’s not just the sticker price. Read on for more information on how interest rates affect the price of a home from Realtor.com, Investopedia, and Home Guides.

Fixed Rates and Bond Interest

Most fixed mortgage rates are heavily based on the same yields that are tied to 10-Year U.S. Treasury Bonds. Homebuyers can determine current interest rate changes for 30 year fixed mortgage rates by examining yields for 10-Year bonds in the market.

The important thing to remember is that if bond yields increase, so do mortgage rates and vice versa.

The Fed

The U.S. Federal Reserve sets a rate at which it lends money…

View original post 347 more words

This entry was posted in agent, broker, interest rates, real estate, realty executives, todd couture and tagged buying a home, communityrealestate360, economy.

Step-by-Step Guide to Home Buying

| HARLOW REALTORS | mid-city speacialist |

- Read, research and decide. Do the math and make sure that this decision benefits you. 10 Signs you’re ready to buy a home!

- Find a local REALTOR that specializes in what you looking to do.

- The REALTOR® can point you in the direction to a lender that would best suite your needs.

- If you’re not equipped to buy, don’t fret! The lender and agent will help you take the steps needed, and give you TIPS to get you where you need to be.

- Every market is different, and every seller has different requirements. Your agent can help prepare you for any upfront costs associated with buying your home.

- Look, play around in the MLS, drive by areas! How do I choose the right neighborhood?

- Once you find a home, in an area and at a price point that works for you, you will write an offer.

- Every market is different. In…

View original post 204 more words

This entry was posted in agent, broker, buying home, for sale, mchenry county, real estate and tagged algonquin, buying a home, buying home, communityrealestate360, crystal lake, first time home buying, home buying.

Realty Executives, Todd Couture

http://m.nwherald.com/2015/05/07/rick-oconnor-group-realty-executives-hire-couture/ai0mz68/

Rick O’Connor Group, Realty Executives hire Couture

By NORTHWEST HERALD — Published: Sunday, May 10, 2015 5:30 a.m. CDT

The Rick O’Connor Group and Realty Executives Cornerstone announced Todd Couture has become the newest member of the agency.

A graduate of Illinois State University, Couture was born and raised in Woodstock, where his parents still live. His father, Fred Spitzer, recently retired from a position with the Woodstock Police Department. Todd, his wife, Jennifer, who works as a nurse practitioner, and their nearly 9-month-old daughter, Mika, now live in Huntley.

Couture studied economics and English in school. He has a background in sales and is hoping to apply that to real estate.

“I chose Realty Executives because of Rick O’Connor,” Couture said in a news release. “Seeing his success over 30-plus years intrigued me. I know if I can be mentored by defining what success is on all levels of Rick’s experience, I want to be a part of that.”

This entry was posted in agent, broker, buying home, mchenry county, real estate, realty executives, selling home, todd couture and tagged agent, broker, mchenry county, real estate, realty executives, todd couture.

Why Every Buyer Needs Their Own Realtor

When we went home shopping we were told by our friend that we should look into getting our own Realtor. Our friend suggested himself, obviously. I am so glad we listened to Ryan’s advice.

Ryan took the time to get to know what we wanted in a home. He steered us in the right direction both price and concept wise. He allowed us to stay focused and helped us find our home.

When we found the right home, he went to work. He sat us down and explained how putting an offer on a house worked. He told us realistically what the house was estimated to be worth and helped us come up with a “just right offer.” When the seller counter-offered he explained why and guided us in the right direction. Thanks to him we got a great deal on a house we absolutely love.

Then came the complicated…

View original post 219 more words

This entry was posted in agent, broker, buying home, for sale, mchenry county, real estate, realty executives, todd couture and tagged 847-471-1434, agent, broker, buying home, communityrealestate360, crystal lake, first time home buying, home market, lakeinthehills, Realtor, spring home sales, spring market, todd couture.

Home Sales Skyrocketing!!

Largest increase in home sales in 5 years. Call me today (847-471-1434) to see how you can be apart of this. The game is changing!

Yesterday, the National Association of Realtors (NAR) released their Existing Home Sales Report. The numbers shocked many analysts as they revealed a 10.4% increaseover the same month last year.

This is the highest number of sales since September 2013. Sales have increased year-over-year for six consecutive months and the 10.4% increase is the highest annual increase since August 2013. March’s sales increase was the largest monthly increase since December 2010.

Lawrence Yun, NAR’s chief economist, explained:

“After a quiet start to the year, sales activity picked up greatly throughout the country in March. The combination of low interest rates and the ongoing stability in the job market is improving buyer confidence and finally releasing some of the sizable pent-up demand that accumulated in recent years.”

Here is a graph showing home sales so far this year:

An increase in sales occurred in every region of the country even…

View original post 126 more words

This entry was posted in agent, buying home, for sale, interest rates, mchenry county, real estate, realty, selling home, todd couture and tagged algonquin, broker, comps, crystal lake, economy, first time home buying, home sales, home value, spring home sales, todd couture.

Good News for ‘Typical’ Home Buyers

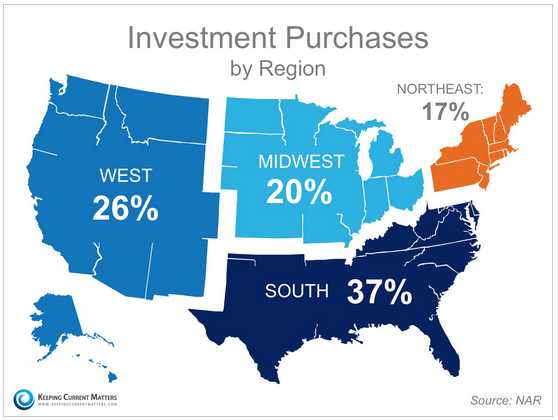

(Above is a map detailing the investment purchases in 2014 by region.)

In a speech delivered earlier this year, Secretary for HUD Julián Castro, called 2015 “A Year of Housing Opportunity”. A recent report by The National Association of Realtors (NAR) revealed that investment home sales decreased 7.4% in 2014 to an estimated 1.02 million.

What does this mean for the ‘typical’ homebuyer?

Lawrence Yun, NAR’s Chief Economist gave some insight:

“Despite strong rental demand in many markets, investment property sales have declined four consecutive years to their lowest share since 2010 as rising home prices and fewer distressed properties coming onto the market have further reduced the number of bargains available to turn into profitable rentals.”

This is great news for the housing market. If fewer properties are being sold to investors, they are instead being sold to American families who are entering the housing market in droves.

Details…

View original post 265 more words

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture and tagged agent, algonquin, broker, buying home, community, communityrealestate360, condominiums, Condos, cook, crystal lake, dupage, economy, first time home buying, flipping, foreclosures, future, home insepection, home insurance, home value, huntley, insurance, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, mortgage, mortgage insurance, northern illinois, property, property for sale, real estate.

Condominium Insurance 101

Tori Denton, PSA, Realtor Licensed MA & CT

Condominium Insurance

Condominium Insurance

One of the benefits of condominium living is that you can enjoy the financial benefits of owning your own home without the time or expense of home maintenance. However, the benefits of belonging to a condo association don’t take away all responsibility if disaster strikes. Although your condo may be covered by master insurance, you should strongly consider purchasing your own condo insurance policy to make sure you are covered in all situations.

Facts

Part of your homeowner’s association dues goes to pay for insurance on your condo complex. If the building burns down, or the roof blows away in a hurricane, you should be covered by your condo’s master insurance policy. Additionally, the master insurance policy will usually carry specialized insurance, such as flood or earthquake insurance. However, this policy won’t cover anything inside your individual unit, so you should consider separate condo insurance to insure your…

View original post 343 more words

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture, Uncategorized and tagged buying home, communityrealestate360, condominiums, Condos, home insurance, huntley, insurance, mchenry county, mortgage insurance, real estate, realty, selling home, todd couture.

Former distressed homeowners with restored credit are re-entering the housing market

Nearly a decade since the start of the foreclosure crisis, formerly distressed homeowners with restored credit are re-entering the housing market, but damaged credit profiles and lender overlays will greatly restrict the overall share of those eligible to buy, according to new research from the National Association of Realtors®.

NAR analyzed the nearly 9.3 million homeowners that underwent a foreclosure, received a deed-in-lieu of foreclosure, or short sold between 2006 and 2014 to estimate the amount of creditworthy borrowers expected to re-enter the housing market as a return buyer in upcoming years.

The findings reveal nearly a million of these former owners have likely already purchased a home again, and an additional 1.5 million are likely to become eligible and purchase over the next five years, representing an additional source of buyer demand for the housing market. However, because of low credit quality, millions more will not be able to re-enter in the coming decade.

Lawrence Yun, NAR chief economist, says there were two waves of defaults during the housing crisis: from subprime and then prime borrowers. “While loose lending standards in the mid-2000’s led to the rise in subprime buyers who ultimately became distressed owners, falling home prices and rising unemployment resulted in a large share of prime borrowers also defaulting or going through a short sale,” he said. “Now fueled by a gradually improving economy and the strong rebound in home prices, some of these former distressed owners have returned to the market, and more will likely become eligible in coming years.”

Several important factors were taken into account in NAR’s study, including the time necessary to repair a distressed seller’s credit, whether the distressed seller’s credit profile (at the time of purchase) fell below historic standards, if it met sound underwriting standards and whether they would meet credit overlays in the current stringent environment.

The findings show that roughly 950,000 former distressed owners of prime quality have become re-eligible for Federal Housing Administration or similar financing programs and have likely purchased again by restoring their credit to pre distress levels. Furthermore, 1.5 million formerly distressed owners will likely buy again over the next five years as they become eligible, with California, Florida and Arizona seeing the largest share of return buyers.

Despite the new source of housing demand from these return buyers, Yun says the considerable impact a distressed sale has on a borrower’s credit score will severely limit the overall number of those returning. “The extended time needed to repair credit scores or save for a downpayment, combined with other overlapping post-distress factors on credit quality such as missed auto loan or credit card payments, will limit the ability for many to buy in the current credit environment,” he said.

Looking ahead, because of the time that has elapsed and the fact that many distressed owners likely rented and paid utility bills in recent years, Yun says the use of new credit scoring models such as Vantage Score 3.0 and FICO 9 can help improve the ability of these buyers to become homeowners again while helping lenders further examine their credit risk to ensure safety and soundness in the market.

“The deep wounds inflicted on the housing market during the downturn are finally beginning to heal as distressed sales continue to decline and home prices in some parts of the country have bounced back to their near-peak levels,” adds Yun. “Borrowers with restored credit will likely have the ability and desire to own again, encouraged by the long-term benefits homeownership provides in a stronger economy and more stable job market.”

The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1 million members involved in all aspects of the residential and commercial real estate industries.

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture and tagged agent, algonquin, broker, buying home, community, cook, crystal lake, dupage, economy, first time home buying, flipping, foreclosures, future, home insepection, home value, huntley, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, mortgage, northern illinois, property, property for sale, real estate, realty, realty executives, selling, selling home, short sales, spring home sales, todd couture, want to sell my home, whats my home worth, woodstock.