algonquin

30-Year vs. 15-Year Mortgage: Four Questions to Ask When Comparing Your Options

Ben Shapiro - Certified Mortgage Planner; CMPS

30-Year vs. 15-Year Mortgage: Four Questions to Ask When Comparing Your Options

Here are four questions that can help you make a more informed decision when comparing a 30-year fixed rate mortgage vs. a 15-year fixed rate mortgage.

1 – What will I do with the difference in cash flow?

There are two main benefits that a 15-year mortgage has vs. a 30-year mortgage:

- 1 – Fifteen year mortgages often carry lower interest rates vs. thirty year mortgages. This could save you some money over time. (See Figure 1 that illustrates what would happen if the interest rate on a 15-year mortgage was 0.5% less than the interest rate on a 30-year mortgage.)

- 2 – Fifteen year mortgages are paid off in half the time of thirty year mortgages. This results in less interest over time and no monthly payments after 15 years. (See Figure 1.)

Even so, you could…

Even so, you could…

View original post 690 more words

This entry was posted in 15 or 30 year fixed rate loan, buying a home, mchenry county, mortgage loans, mortgage rates, real estate, todd couture and tagged @realtorcouture, algonquin, buying a home, huntley, mortgage loans, mortgage rates, real estate, todd couture.

5 Things You Absolutely Must Do Before Buying a Home

5 Things You Absolutely Must Do Before Buying a Home

Purchasing real estate can be a complex process, and it’s essential for people who want to make a smart wealth-building decision to buy the right property that suits their long-term needs. To prepare yourself for this life-changing event, be sure you take the following steps before starting the process. READ MORE

Ready to Sell Your Home? Ready to Buy? Search for Homes for sale in Columbia, South Carolina & Search for Homes for sale in Lexington and Lake Murray, South Carolina

This entry was posted in buying home, real estate, real estate agent huntley illinois, todd couture and tagged @realtorcouture, algonquin, buying home, huntley, huntley illinois, real estate, realty executives cornerstone, todd couture.

Step-by-Step Guide to Home Buying

| HARLOW REALTORS | mid-city speacialist |

- Read, research and decide. Do the math and make sure that this decision benefits you. 10 Signs you’re ready to buy a home!

- Find a local REALTOR that specializes in what you looking to do.

- The REALTOR® can point you in the direction to a lender that would best suite your needs.

- If you’re not equipped to buy, don’t fret! The lender and agent will help you take the steps needed, and give you TIPS to get you where you need to be.

- Every market is different, and every seller has different requirements. Your agent can help prepare you for any upfront costs associated with buying your home.

- Look, play around in the MLS, drive by areas! How do I choose the right neighborhood?

- Once you find a home, in an area and at a price point that works for you, you will write an offer.

- Every market is different. In…

View original post 204 more words

This entry was posted in agent, broker, buying home, for sale, mchenry county, real estate and tagged algonquin, buying a home, buying home, communityrealestate360, crystal lake, first time home buying, home buying.

This entry was posted in buying home, for sale, mchenry county, real estate, realty executives, selling home, todd couture and tagged 847-471-1434, agent, algonquin, broker, communityrealestate360, crystallake, economic outlook, home market, home sales, huntley, mchenry county, spring home sales, todd couture.

Home Sales Skyrocketing!!

Largest increase in home sales in 5 years. Call me today (847-471-1434) to see how you can be apart of this. The game is changing!

Yesterday, the National Association of Realtors (NAR) released their Existing Home Sales Report. The numbers shocked many analysts as they revealed a 10.4% increaseover the same month last year.

This is the highest number of sales since September 2013. Sales have increased year-over-year for six consecutive months and the 10.4% increase is the highest annual increase since August 2013. March’s sales increase was the largest monthly increase since December 2010.

Lawrence Yun, NAR’s chief economist, explained:

“After a quiet start to the year, sales activity picked up greatly throughout the country in March. The combination of low interest rates and the ongoing stability in the job market is improving buyer confidence and finally releasing some of the sizable pent-up demand that accumulated in recent years.”

Here is a graph showing home sales so far this year:

An increase in sales occurred in every region of the country even…

View original post 126 more words

This entry was posted in agent, buying home, for sale, interest rates, mchenry county, real estate, realty, selling home, todd couture and tagged algonquin, broker, comps, crystal lake, economy, first time home buying, home sales, home value, spring home sales, todd couture.

What is Appraised Value?

Get a price on your home right now. Its easy comes directly from the MLS. Click here http://bit.ly/1bMB1La

The Real Estate Savvy by Myra Spano

- Appraisals provide an objective opinion of value, but it’s not an exact science so appraisals may differ.

- For buying and selling purposes, appraisals are usually based on market value — what the property could probably be sold for. Other types of value include insurance value, replacement value, and assessed value for property tax purposes.

- Appraised value is not a constant number. Changes in market conditions can dramatically alter appraised value.

- Appraised value doesn’t take into account special considerations, like the need to sell rapidly.

- Lenders usually use either the appraised value or the sale price, whichever is less, to determine the amount of the mortgage they will offer.

View original post 107 more words

This entry was posted in Uncategorized and tagged algonquin, comps, crystallake, elgin, homevalue, huntley, lakeinthehills, selling, sellinghome, woodstock.

Good News for ‘Typical’ Home Buyers

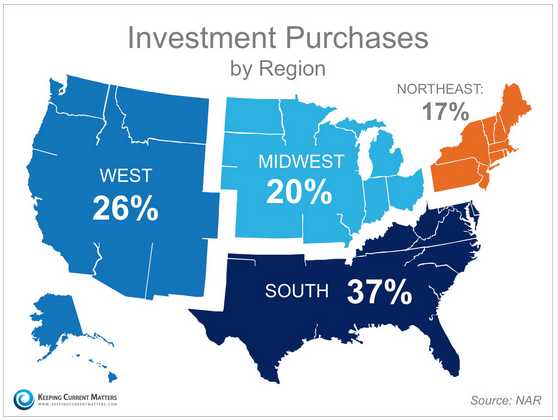

(Above is a map detailing the investment purchases in 2014 by region.)

In a speech delivered earlier this year, Secretary for HUD Julián Castro, called 2015 “A Year of Housing Opportunity”. A recent report by The National Association of Realtors (NAR) revealed that investment home sales decreased 7.4% in 2014 to an estimated 1.02 million.

What does this mean for the ‘typical’ homebuyer?

Lawrence Yun, NAR’s Chief Economist gave some insight:

“Despite strong rental demand in many markets, investment property sales have declined four consecutive years to their lowest share since 2010 as rising home prices and fewer distressed properties coming onto the market have further reduced the number of bargains available to turn into profitable rentals.”

This is great news for the housing market. If fewer properties are being sold to investors, they are instead being sold to American families who are entering the housing market in droves.

Details…

View original post 265 more words

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture and tagged agent, algonquin, broker, buying home, community, communityrealestate360, condominiums, Condos, cook, crystal lake, dupage, economy, first time home buying, flipping, foreclosures, future, home insepection, home insurance, home value, huntley, insurance, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, mortgage, mortgage insurance, northern illinois, property, property for sale, real estate.

FOMC Meeting Forecast – The FED

FEDS LOOKING AT RATE HIKES, BUT NOT UNTIL MAYBE JUNE AT THE EARLIEST OR MORE PROABABLY SEPTEMBER. @realtorcouture

Who can forget the last 2014 FED´s meeting, when Janet Yellen talked for the first time of a possible date for rate hike, and talked about the probability of a couple of months, and not before April? During the December meeting, the FED said that it would be “patient” on rates, and said it was unlikely they will change the economic policy at least for a “couple of meetings”, with Chair Janet Yellen clarifying then that a couple of meetings meant not before April. At the time, the Central Bank was confident on the economic outlook, saying that that the “economic activity has been expanding at a solid pace” and market run to price in a rate hike for June.

But as the months went by, persistent softness in the economy, with macroeconomic data printing some horrid numbers, has diminished hopes the Central Bank will act that soon.

On…

View original post 441 more words

This entry was posted in Uncategorized and tagged agent, algonquin, broker, buying home, community, communityrealestate360, condominiums, Condos, cook, crystal lake, dupage, economy, first time home buying, flipping, foreclosures, future, home insepection, home insurance, home value, huntley, insurance, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, mortgage, mortgage insurance, northern illinois, property, property for sale, real estate, realestate.com, Realtor, realtor.com, realty, realty executives, selling, selling home, short sales, spring home sales, todd couture, trulia, want to sell my home, whats my home worth, woodstock, zillow.

Former distressed homeowners with restored credit are re-entering the housing market

Nearly a decade since the start of the foreclosure crisis, formerly distressed homeowners with restored credit are re-entering the housing market, but damaged credit profiles and lender overlays will greatly restrict the overall share of those eligible to buy, according to new research from the National Association of Realtors®.

NAR analyzed the nearly 9.3 million homeowners that underwent a foreclosure, received a deed-in-lieu of foreclosure, or short sold between 2006 and 2014 to estimate the amount of creditworthy borrowers expected to re-enter the housing market as a return buyer in upcoming years.

The findings reveal nearly a million of these former owners have likely already purchased a home again, and an additional 1.5 million are likely to become eligible and purchase over the next five years, representing an additional source of buyer demand for the housing market. However, because of low credit quality, millions more will not be able to re-enter in the coming decade.

Lawrence Yun, NAR chief economist, says there were two waves of defaults during the housing crisis: from subprime and then prime borrowers. “While loose lending standards in the mid-2000’s led to the rise in subprime buyers who ultimately became distressed owners, falling home prices and rising unemployment resulted in a large share of prime borrowers also defaulting or going through a short sale,” he said. “Now fueled by a gradually improving economy and the strong rebound in home prices, some of these former distressed owners have returned to the market, and more will likely become eligible in coming years.”

Several important factors were taken into account in NAR’s study, including the time necessary to repair a distressed seller’s credit, whether the distressed seller’s credit profile (at the time of purchase) fell below historic standards, if it met sound underwriting standards and whether they would meet credit overlays in the current stringent environment.

The findings show that roughly 950,000 former distressed owners of prime quality have become re-eligible for Federal Housing Administration or similar financing programs and have likely purchased again by restoring their credit to pre distress levels. Furthermore, 1.5 million formerly distressed owners will likely buy again over the next five years as they become eligible, with California, Florida and Arizona seeing the largest share of return buyers.

Despite the new source of housing demand from these return buyers, Yun says the considerable impact a distressed sale has on a borrower’s credit score will severely limit the overall number of those returning. “The extended time needed to repair credit scores or save for a downpayment, combined with other overlapping post-distress factors on credit quality such as missed auto loan or credit card payments, will limit the ability for many to buy in the current credit environment,” he said.

Looking ahead, because of the time that has elapsed and the fact that many distressed owners likely rented and paid utility bills in recent years, Yun says the use of new credit scoring models such as Vantage Score 3.0 and FICO 9 can help improve the ability of these buyers to become homeowners again while helping lenders further examine their credit risk to ensure safety and soundness in the market.

“The deep wounds inflicted on the housing market during the downturn are finally beginning to heal as distressed sales continue to decline and home prices in some parts of the country have bounced back to their near-peak levels,” adds Yun. “Borrowers with restored credit will likely have the ability and desire to own again, encouraged by the long-term benefits homeownership provides in a stronger economy and more stable job market.”

The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1 million members involved in all aspects of the residential and commercial real estate industries.

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture and tagged agent, algonquin, broker, buying home, community, cook, crystal lake, dupage, economy, first time home buying, flipping, foreclosures, future, home insepection, home value, huntley, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, mortgage, northern illinois, property, property for sale, real estate, realty, realty executives, selling, selling home, short sales, spring home sales, todd couture, want to sell my home, whats my home worth, woodstock.

REALTY EXECUTIVES CORNERSTONE & THE RICK O’CONNOR GROUP HAVE WELCOMED A NEW EXECUTIVE!

REALTY EXECUTIVES CORNERSTONE & THE RICK O’CONNOR GROUP HAVE WELCOMED A NEW EXECUTIVE!

The Rick O’Connor Group and Realty Executives Cornerstone are proud to announce that we now have a new Executive joining our team. Todd Couture has become the newest member of our bustling agency as of April 2015. A graduate of ISU, Todd is an Illinois native with strong ties to the McHenry County community as a whole. He was born and raised in Woodstock, where his parents still live, and his father, Fred Spitzer recently retired from a position with the Woodstock Police Department. Todd, his wife Jennifer who works as a nurse practitioner, and their nearly 9 month old daughter, Mika, now live in Huntley.

Todd, who studied economics and English while in school, has proven his ability to adapt in a small business environment and is looking forward to tackling the real estate realm. He has a strong background in sales and is hoping to apply that in this booming industry. Todd expects to use his existing business knowledge, paired with the real estate experience of our office, to launch his career as a broker at full-speed during the spring market.

Beyond work, Todd enjoys spending time with his family and keeping up with community events. He founded two social media pages on Facebook and Twitter called Huntley 360. Todd says the goal of these pages is “informing Huntley and the surrounding areas about what is happening: from sports, kids in the community, places to go, and community updates to home values and market information.” Growing up with five siblings, Todd has an excellent understanding of the importance of a sense of community and intends to try to convey that in his real estate endeavor.

“I chose Realty Executives because of Rick O’Connor,” Couture explained. “Seeing his success over 30+ years intrigued me. I know if I can be mentored by defining what success is on all levels of Rick’s experience, I want to be a part of that,” he stated. We are very excited to add Todd to our Realty Executives family and know he will find success in this industry. When asked what drives him, Todd explained “my passion is about relationships in the community. I want to help build the community as a whole.”

“We are all very excited to have Todd join our team of Executives,” explained Rick O’Connor, Owner and Managing Broker of Realty Executives Cornerstone. “He has already demonstrated a strong desire to be a study of the marketplace and to become one of the area’s top real estate professionals. He will make a great addition to our Cornerstone family.” Welcome aboard Todd Couture!

This entry was posted in agent, broker, buying home, community, for rent, for sale, foreclosures, interest rates, invesment property, mchenry county, real estate, realty, realty executives, rick o'connor, selling home, todd couture, Uncategorized and tagged agent, algonquin, broker, buying home, community, cook, crystal lake, first time home buying, flipping, home insepection, home value, huntley, interest rates, investment, investment property, kane, lake, land, market, mchenry, mchenry county, northern illinois, property, property for sale, real estate, realestate.com, Realtor, realtor.com, realty executives, selling home, todd couture, trulia, woodstock, zillow.